What are bookkeeping reports and why are they important?

Bookkeeping reports are summaries of the current financial state of your business.

In other words, bookkeeping reports show you how well your business has performed for a set time period and can help project future sales and expenses for more informed business decisions.

So why are your bookkeeping reports so important???

The information from your bookkeeping reports informs your financial statements. Your financial statements are used to get credit from your bank, submit to HMRC and internally for business planning.

Your bookkeeping reports also help make timely business decisions and can highlight areas of improvement in your business.

There are 4 main bookkeeping reports...

- Aged Debtors

- Aged Creditors

- Profit and Loss

- Trial Balance

Lets take a look at these in turn...

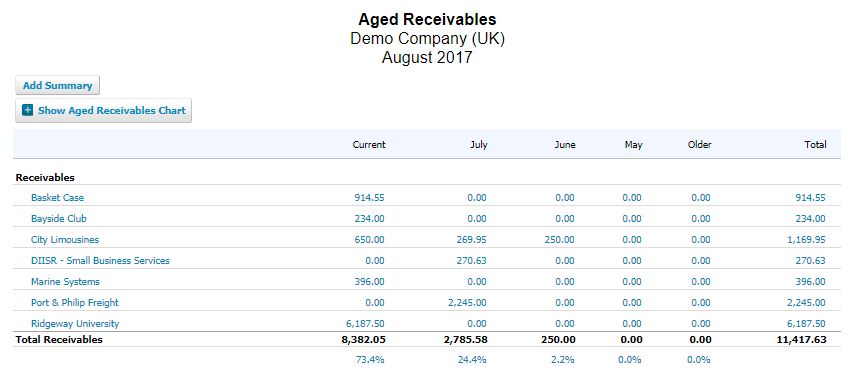

Aged Debtors and Aged Creditors Report

- Aged Debtors

- Aged Creditors

Lets start with the aged debtors report...

The aged debtors report is a list of all the sales invoices your customers haven't paid yet minus any credit notes you've given to your customers and haven't refunded them yet.

The report is really useful for following up sales invoices...

Your aged debtors report shows your invoices and credit notes by customer and date allowing you to identify which customers aren't paying you on time, the total amount each customer owes you and it allows you to follow-up your unpaid invoices.

Here is an example of an aged debtors report from the Xero Demo Company...

And...

The aged creditors report is a list of all the bills you haven't paid yet minus any credit notes you haven't been refunded for yet.

The report is really effective for cash flow...

Your aged creditor report displays your bills by supplier and date allowing you to view the total amount you owe your suppliers and when those payments are due which can help you plan your expenses for better cash flow.

Here is an example of an aged creditors report from the Xero Demo Company...

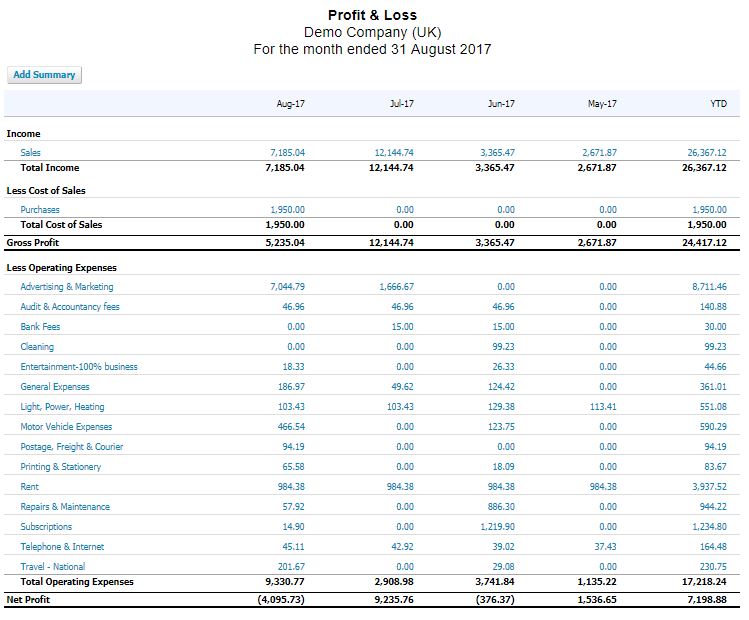

Profit and Loss Report

The profit and loss report is pretty self explanatory. The "P&L" report displays your business' income and expenses which include total income from sales, cost of goods sold, gross profit, expanses and net profit.

So what does all that mean?

(NOTE: Now that you know how bookkeeping reports can help your business, you need to make sure that those reports are accurate. To do that you need a good bookkeeper... But, what makes a good bookkeeper? Click learn more to find out...)

Lets take a look at each section...

- Income - All the money you made from sales of your products or services.

- Cost of Good Sold - The total of your expenses that you have invoiced your customers for.

- Gross Profit - The total amount calculated from Income plus Cost of Good Sold.

- Expenses - Other expenses not included in your Cost of Goods Sold.

- Net Profit - The total amount calculated from gross profit minus expenses.

Here is an example of a profit and loss report from the Xero Demo Company...

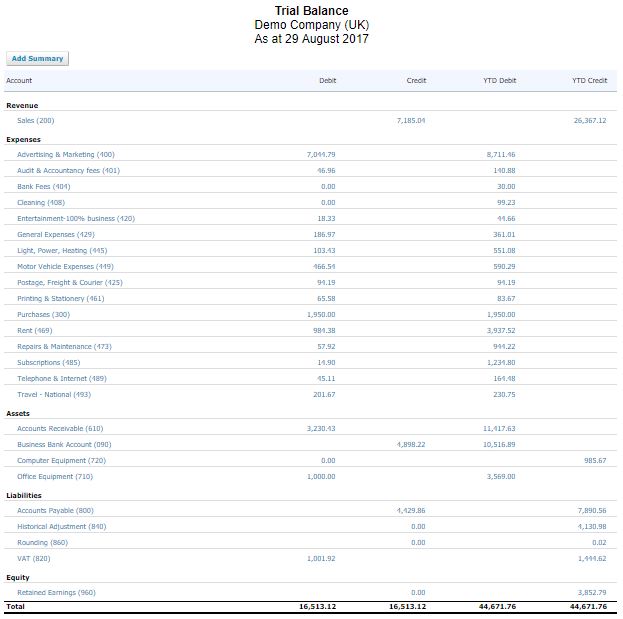

Trial Balance Report

The trial balance is a list of your account's closing balances on a certain date. There are 5 sections that make up your business' accounts:

- Revenue

- Expenses

- Assets

- Liabilities

- Equity

The trail balance is the initial step to preparing your business' financial statements and are usually processed at the end of an accounting period.

The ledger balances are made up of 2 sections:

- Debit Balances - include assets and expenses

- Credit Balances - include liabilities, capital and income.

If your bookkeeping is done correctly, the sum of your debit balances should be equal to the total of your credit balances.

Here is an example of a trial balance from the Xero Demo Company...

So, now that you understand your bookkeeping reports a little better, you can start using these reports to make improvements in your business.

For example...

If you find out from your aged debtors report that your customers and consistently paying you late, see if there is an easier way for them to pay you. That makes their life easier and you get paid faster.

What if you found from your profit and loss report that your net profit was lower than you'd like. Maybe you can spread costs or cut them entirely to increase your profit margin or add products and services to try and increase income.

If you have any questions about your bookkeeping reports or want more use cases, let us know.

(NOTE: Now that you know how bookkeeping reports can help your business, you need to make sure that those reports are accurate. To do that you need a good bookkeeper... But, what makes a good bookkeeper? Click learn more to find out...)